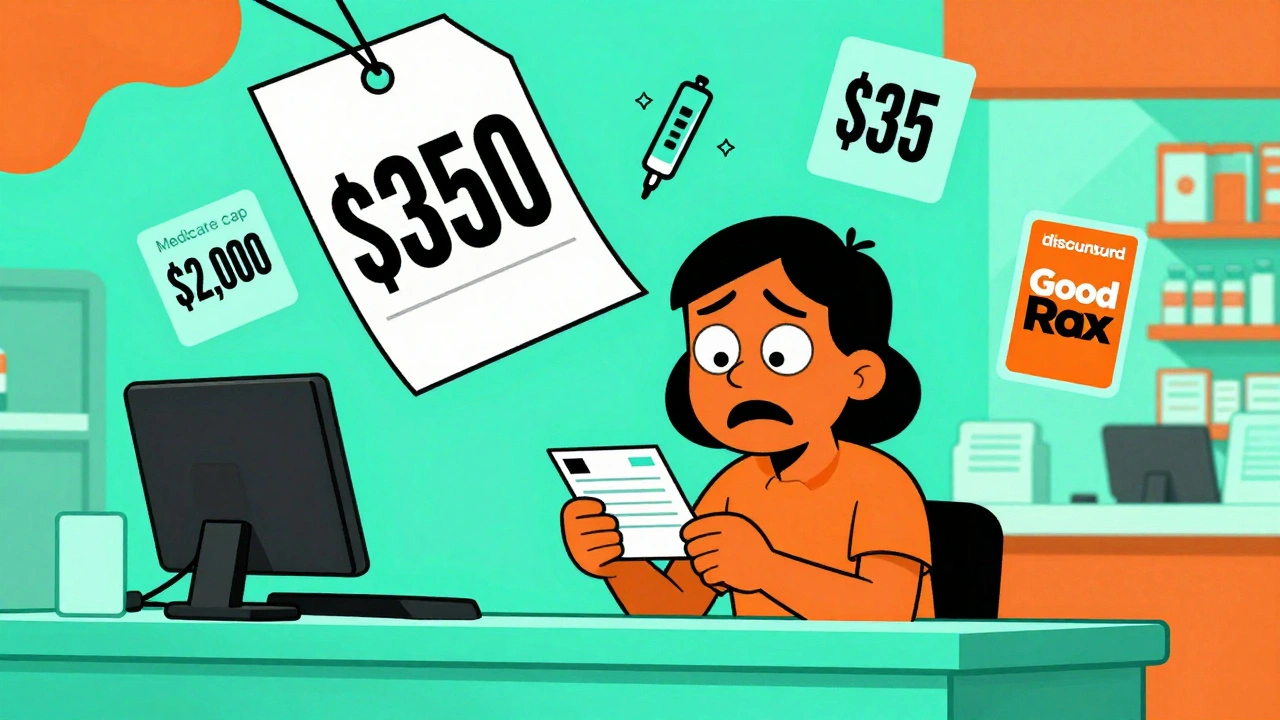

Imagine this: you leave your doctor’s office with a new prescription, excited to start feeling better. But at the pharmacy, the pharmacist says your copay is $350. You didn’t expect that. You didn’t even know your insurance didn’t cover this drug. So you leave without it. This happens to 22% of people in the U.S. every year - and it’s entirely avoidable.

The key isn’t just having insurance. It’s knowing what your insurance actually covers - and asking the right questions before the prescription is even written. Talking about cost before you fill a prescription isn’t awkward. It’s essential. And it’s becoming standard practice, especially with new federal rules that took effect in 2024 and 2025.

Why Cost Discussions Matter Now More Than Ever

In 2025, Medicare Part D beneficiaries won’t pay more than $2,000 out-of-pocket for prescriptions in a year. That’s a huge change from 2024, when the cap was $8,000. This new limit, part of the Inflation Reduction Act, means millions of seniors will finally have real protection against sky-high drug bills. But if you’re on a commercial plan - not Medicare - you might not have any cap at all. Some plans charge 25-33% coinsurance for specialty drugs with no annual limit.

And it’s not just about caps. Insulin costs are now capped at $35 per month for Medicare beneficiaries. Many commercial plans have followed suit, but not all. If you’re on insulin, you should know this. If you’re on any other chronic medication - blood pressure pills, diabetes drugs, antidepressants - you need to know what you’re signing up for.

Studies show patients who talk about cost with their doctors are 37% less likely to skip doses because of price. That’s not a small number. That’s life-changing.

What You Need to Know Before Your Appointment

Don’t wait until you’re at the pharmacy to find out your medication costs. Start preparing before your appointment.

- Check your insurance plan’s formulary. Every insurer has a list of covered drugs, broken into tiers. Tier 1 is usually generics ($5-$15 copay). Tier 2 is preferred brands ($25-$50). Tier 3 is non-preferred brands ($50-$100). Specialty tiers can cost hundreds. If your drug is on Tier 4 or 5, you’re in for a surprise.

- Know your deductible status. If you’re early in the year (January-March), you might still be paying full price before your deductible is met. A $480 deductible isn’t unusual for a marketplace plan. That means you pay $480 before insurance kicks in - even for a $100 drug.

- Write down your medications. Include the name, dose, and how often you take them. If you’re switching drugs, note why - maybe your old one was cheaper or better tolerated.

Some people use tools like GoodRx, SingleCare, or RxSaver to compare cash prices. These aren’t insurance - they’re discount cards. But they often beat your insurance copay. One patient in Perth saved $287 on blood pressure meds by showing her pharmacist a GoodRx price and asking if she could use it instead of insurance.

What to Say to Your Doctor

Bring this up early in the visit. Don’t wait until the end. Say something like:

- “I’m on a tight budget. Is there a generic version of this drug?”

- “Will this be covered under my plan? What’s my out-of-pocket cost?”

- “Are there other options that work similarly but cost less?”

- “Can you check if my insurance requires prior authorization for this?”

Doctors aren’t always trained to know drug prices. But they can ask. Many now use Real-Time Prescription Benefit (RTPB) tools built into electronic health records. These tools show the patient’s exact copay based on their plan, deductible, and pharmacy. If your doctor doesn’t use it, ask if they can check.

Don’t be shy. The American Medical Association has recommended cost discussions since 2018. Your doctor is there to help you get better - not broke.

What to Ask the Pharmacist

If your doctor writes the script and you’re still unsure, call your pharmacy before picking it up. Ask:

- “What’s my copay for this drug with my insurance?”

- “Is there a lower-cost alternative on my formulary?”

- “Can I get a 90-day supply for a lower price?”

- “Do you offer a mail-order option?”

- “Is there a patient assistance program I qualify for?”

Pharmacists are your last line of defense. The American Pharmacists Association says they should step in if a patient’s out-of-pocket cost exceeds 2% of their monthly income. For someone earning $3,000 a month, that’s $60. If the drug costs more than that, the pharmacist should offer alternatives.

Medicare vs. Commercial Insurance: Key Differences

Medicare Part D plans must cover at least two drugs per category, and now have a hard $2,000 annual cap. They also offer monthly payment plans starting in 2025 - so you pay a little each month instead of a big bill at the pharmacy.

Commercial plans? No such guarantees. Bronze plans average $500 deductibles. Silver plans average $350. But after that, you might pay 25-33% coinsurance on specialty drugs - with no cap. One patient paid $1,200 a month for a cancer drug because her plan had no out-of-pocket maximum. She didn’t know until she got to the pharmacy.

Medicaid usually has low copays - $1 to $3 - but often requires prior authorization. That means your doctor has to get approval before the drug is covered. It can take days. Don’t assume it’s automatic.

Specialty Drugs Are the Biggest Trap

These are drugs for complex conditions - rheumatoid arthritis, MS, cancer, rare diseases. They cost hundreds or thousands per month. And 68% of them require prior authorization. Even if your plan covers them, you might not get approval right away.

Here’s what to do:

- Ask your doctor to submit the prior auth request the same day they write the script.

- Call your insurer to check the status. Don’t wait for them to call you.

- If denied, ask your doctor to appeal. Most appeals are successful if the doctor explains why the drug is medically necessary.

And if you’re on Medicare, remember: insulin is capped at $35. But other specialty drugs? Not yet. You still need to fight for affordability.

When to Use Prescription Payment Plans

Starting in 2025, Medicare Part D plans must offer monthly payment plans. You pay a fixed amount each month, spread out over the year. This helps if you’re on a fixed income or have high drug costs.

But here’s the catch: if you enroll after September, you won’t have enough months left in the year to spread the cost. You’ll still pay a big bill at the pharmacy. So if you need a new drug in November, don’t wait. Ask your pharmacist about payment options now.

Commercial plans don’t offer this yet. But some pharmacies (like CVS and Walgreens) have their own payment plans. Ask.

What to Do If You Can’t Afford It

If you’re stuck with a high-cost drug and can’t pay:

- Ask your doctor for samples. Many still have them.

- Check drugmaker assistance programs. Most big pharma companies offer free or discounted drugs to low-income patients.

- Use GoodRx or SingleCare. Even if you have insurance, the cash price might be lower.

- Contact the Patient Advocate Foundation. They help people navigate coverage denials and financial aid.

Don’t give up. 43% of cost-related issues are resolved when providers file prior authorizations or switch to a covered drug. You’re not alone. And you don’t have to suffer because you can’t afford your meds.

Final Checklist Before You Leave the Office

Before you walk out, make sure you’ve covered these five things:

- Is this drug on my insurance’s formulary?

- What’s my exact out-of-pocket cost? (Ask for a number, not a range.)

- Is there a generic or preferred alternative?

- Do I need prior authorization? Who handles it?

- Can I get a 90-day supply to save money?

If you can’t answer all five, don’t leave without getting the answers. Write them down. Call your insurer if you need to.

Medication costs shouldn’t be a guessing game. You have the right to know. And with the new rules in place, you have more power than ever to control your expenses.

What should I do if my insurance doesn’t cover my prescription?

Ask your doctor for an alternative drug that’s on your plan’s formulary. If there isn’t one, ask them to file a prior authorization request. You can also check patient assistance programs from the drug manufacturer, use discount cards like GoodRx, or contact the Patient Advocate Foundation for help navigating coverage denials.

Can I use GoodRx instead of my insurance?

Yes. GoodRx often offers lower prices than your insurance copay, especially for generic drugs. At the pharmacy, ask if you can use the GoodRx discount instead of your insurance. You can’t combine them, but you can choose the cheaper option.

Why is my copay so high even though I have insurance?

Many commercial plans have high deductibles or coinsurance for brand-name or specialty drugs. If you haven’t met your deductible, you pay full price. Even after meeting it, you might pay 25-33% of the drug’s cost. Medicare Part D has a $2,000 annual cap - commercial plans usually don’t.

When is the best time to discuss medication costs?

During your doctor’s visit, before the prescription is written. That’s when you have the most options. Once the script is written, switching drugs or filing prior authorizations takes more time and effort.

Do all pharmacies have the same prices?

No. Prices vary widely between pharmacies, even for the same drug and insurance. Use tools like GoodRx to compare prices at nearby pharmacies. Sometimes the cheapest option is a small local pharmacy, not a big chain.

Is there help for people on low income?

Yes. Many drug manufacturers offer free or discounted medications through patient assistance programs. Medicaid also covers nearly all FDA-approved drugs with low copays. Check with your state’s Medicaid office or the Partnership for Prescription Assistance for eligibility.

Comments

Jim Irish

December 10, 2025 AT 22:38This is the kind of info every American needs to hear. Too many people get blindsided by drug costs and end up skipping doses or going into debt. Just knowing you can ask your doctor about alternatives makes a huge difference.

It’s not about being rude-it’s about being smart.

Mia Kingsley

December 11, 2025 AT 18:03OMG I JUST HAD THIS HAPPEN TO ME LAST WEEK AND I WAS SO MAD I CRIED IN THE PHARMACY PARKING LOT LIKE A BABY 😭

THEY SAID 480 FOR A MONTH OF MY ANTIDEPRESSANT AND I WAS LIKE WAIT WHAT I PAID 15 LAST YEAR

TURNED OUT I HIT MY DEDUCTIBLE BUT NO ONE TOLD ME

DOCTORS ARENT HELPING THEY JUST WRITE THE PRESCRIPTION AND RUN

Katherine Liu-Bevan

December 13, 2025 AT 10:37There’s a critical gap in public awareness here. Many patients assume their insurance covers everything, especially if they’ve had the same plan for years. The tier system isn’t just bureaucratic-it’s financially lethal if you’re on a specialty drug.

Doctors need training to proactively check formularies before prescribing. And pharmacies should be required to display out-of-pocket costs before the transaction is finalized. This isn’t optional anymore-it’s a public health issue.

Eddie Bennett

December 13, 2025 AT 14:29I used to think asking about cost was weird. Then my mom got diagnosed with RA and the first drug they prescribed was $1,200 a month. We didn’t know until we got to the counter.

Turns out there’s a generic biosimilar that costs $200 and works just as well. My mom’s on it now. No one told us. No one asked.

Just say the words. It’s not embarrassing. It’s survival.

Sylvia Frenzel

December 14, 2025 AT 20:36Why are we even letting drug companies get away with this? In Canada you pay $5 for anything. In Germany it’s capped. We’re the only rich country where you need a loan to take your pills.

It’s not a system failure. It’s a moral failure.

Michaux Hyatt

December 15, 2025 AT 10:33GoodRx saved me $300 on my cholesterol med last year. I didn’t even know it was an option until my pharmacist mentioned it. I thought insurance was always the way to go.

But sometimes the cash price is lower than your copay-especially if you haven’t met your deductible. Ask. Always ask.

And if your doctor looks confused? Push harder. They’re not price experts, but they can find out.

Raj Rsvpraj

December 17, 2025 AT 06:27Jack Appleby

December 18, 2025 AT 11:36Let’s be brutally honest: most people don’t read their insurance documents because they’re written in legalese that even lawyers avoid. The real solution isn’t asking doctors to check formularies-it’s forcing insurers to publish real-time, dynamic pricing APIs that pharmacies and EHRs can integrate automatically. No more guessing. No more surprises. Just a flat, transparent number before the script is even written.

And while we’re at it, ban tiered formularies. They’re a scam disguised as cost management.