Ever wonder why your doctor prescribes a generic pill, but your insurance won’t cover it? Or why another generic is covered instantly, even though they’re both the same active ingredient? It’s not random. It’s not a glitch. It’s a system - and it’s designed to save money without sacrificing care. But here’s the truth: how insurers choose which generics to cover isn’t about brand loyalty or pharmacy deals. It’s about science, cost, and strict rules you rarely see.

The Formulary Is the Rulebook

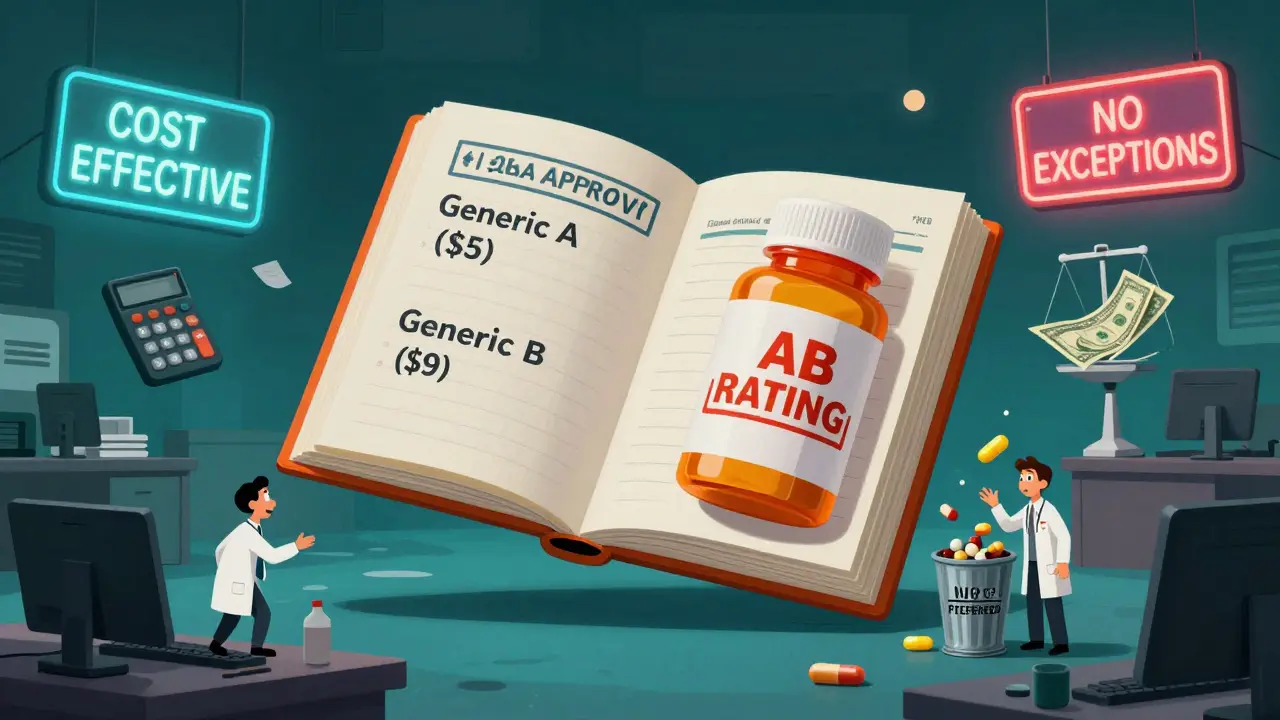

Every health plan - whether it’s Medicare, Medicaid, or your employer’s plan - has a formulary. Think of it like a shopping list of drugs the insurer will pay for. And when it comes to generics, that list is heavily stacked in favor of a few key players. The goal? Keep your out-of-pocket costs low, but only if the drug meets three non-negotiable criteria: it’s FDA-approved, clinically effective, and cheaper than alternatives.Here’s how it works in practice: 92% of Medicare Part D plans put all their generics in Tier 1 - the lowest cost tier. That means you pay $0 to $15 for a 30-day supply. Compare that to a brand-name drug in Tier 3 or 4, which can cost $40 to $100 or more. Insurers don’t do this out of kindness. They do it because generics cost 80-85% less than their brand-name versions. From 2007 to 2019, Medicare Part D saved $1.67 trillion just by using generics. In 2019 alone, that number hit $141 billion.

Who Decides? The P&T Committee

Behind every formulary is a Pharmacy & Therapeutics (P&T) committee. These aren’t marketing teams. They’re groups of doctors, pharmacists, and data analysts who meet regularly to review drugs. Their job? Decide what stays on the list and what gets kicked off.They don’t just look at price. They dig into real-world evidence. Did the drug work in diverse patient groups? Were there more side effects in older adults? Did it reduce hospital visits? Blue Shield of California, Humana, and Cigna all say the same thing: a generic must be therapeutically equivalent to the brand-name drug. That’s not a suggestion - it’s a federal requirement. The FDA gives it an “AB” rating, meaning it’s interchangeable. If it doesn’t have that rating, it’s not even considered.

But here’s where it gets tricky. Two generics can both be FDA-approved and therapeutically equivalent - yet only one makes it onto the formulary. Why? Cost-effectiveness. If Generic A costs $5 and Generic B costs $8, and they work the same, Generic A wins. No debate. That’s the rule. The P&T committee doesn’t care who makes it. They care what it costs and whether it works.

Tiers Don’t Lie - But They Don’t Tell the Whole Story

You’ve probably seen those tiered formularies on your insurance card. Tier 1: generics. Tier 2: preferred brands. Tier 3: non-preferred brands. Tier 4: specialty drugs. Simple, right?Not quite. The labels are standardized, but the contents aren’t. One insurer’s “preferred generic” might be a different manufacturer than another’s. Some plans have “preferred” and “non-preferred” generics within Tier 1. That means even if you’re on a generic, you might still pay more if it’s not the one the insurer picked. And you won’t know until you get to the pharmacy.

Take Humana’s 2023 plan structure: in a 5-tier system, Tier 1 is “preferred, low-cost generic drugs.” That means not all generics are treated equally. If your doctor prescribes a generic that’s not on the preferred list, you might get hit with a higher copay - or worse, a denial. That’s why some patients end up paying hundreds extra a year, even on generics.

Why Some Generics Get Blocked - Even When They’re FDA-Approved

You’d think if the FDA says it’s safe and effective, the insurer has to cover it. Not true. Insurers can - and do - exclude FDA-approved generics if they’re not cost-effective or if there’s a cheaper alternative. That’s legal. That’s policy.Here’s an example: Two generics for high blood pressure, both FDA-approved. One costs $4 a month. The other costs $9. The cheaper one gets covered. The more expensive one? Not unless your doctor files an exception. And even then, you need proof - like a documented allergic reaction, or that the cheaper version didn’t work for you. That’s not just paperwork. It’s a barrier.

Doctors spend an average of 13.3 hours a week just dealing with prior authorizations and formulary exceptions. That’s more than a full workday every month. And patients? They’re the ones stuck in the middle, waiting days for an answer while their meds run out.

What Happens When a Generic Isn’t Covered?

If your generic isn’t on the formulary, you have options - but they’re not easy.First, your doctor can request an exception. They’ll need to show one of three things: the covered generic caused side effects, it didn’t work for you, or it requires a dosage higher than the insurer allows. Once submitted, the insurer has three business days to respond. One day if it’s urgent. If they don’t reply? The request is automatically approved. That’s the law.

But here’s the catch: 43% of patients get denied the first time. That doesn’t mean they’re out of luck. 78% eventually get coverage after appealing. The problem? Most people don’t know they can appeal. Or they don’t have the time. Or their doctor won’t fight for it.

On Reddit’s r/healthinsurance, a common thread is: “My generic wasn’t covered. What now?” The top answer? “Call your pharmacy. Ask them to check if there’s a preferred alternative. Then ask your doctor to write a letter.” It’s not glamorous. But it works.

Therapeutic Substitution: The Hidden Trade-Off

Here’s something most patients don’t realize: your pharmacist can swap your brand-name drug for a generic - even if your doctor didn’t prescribe it. That’s called therapeutic substitution. And it’s legal in 78% of commercial plans.That sounds great, right? Lower cost, same results. But not always. A 2023 Drug Topics survey found that 31% of patients reported adverse effects after being switched to a different generic. Not because the drug was unsafe. But because the inactive ingredients - the fillers, dyes, coatings - can affect how the drug is absorbed. For some people, especially those with chronic conditions like epilepsy or thyroid disease, that tiny difference matters.

Insurers don’t track those outcomes. They track cost savings. That’s the disconnect. The system works for most. But for a significant minority, it creates real health risks.

What’s Changing in 2025 and Beyond?

The rules are shifting. The Inflation Reduction Act of 2022 capped out-of-pocket drug costs at $2,000 a year for Medicare Part D starting in 2025. That’s huge. It means insurers can’t just push patients toward the cheapest drug anymore - they have to think about total cost of care.Also, the FDA is speeding up approval of complex generics - like inhalers, insulin pens, and injectables. That means more options will hit the market. And with the Generic Drug User Fee Amendments (GDUFA III), approval times could drop from 42 months to 10. More generics = more competition = lower prices.

But there’s a dark side. As of October 2023, 78% of the 372 active drug shortages in the U.S. were generics. Why? Because manufacturers stop making them if they’re not profitable. If your insurer only covers one generic, and that one goes out of stock? You’re stuck. No backup. No coverage.

And then there’s the future: AI-driven personalized generics. These are still in development, but P&T committees are already scratching their heads. How do you evaluate a drug that’s made just for you? What’s the cost? Who pays? No one has answers yet.

What You Can Do

You can’t control the formulary. But you can navigate it.- Ask your pharmacist: “Is this the preferred generic for my drug?”

- If it’s not covered, ask your doctor: “Can you file an exception? What do I need to prove?”

- Check your plan’s formulary online - every insurer posts it. Don’t wait until you’re at the pharmacy.

- If you’re on a chronic medication, ask about therapeutic substitution. Know what you’re being switched to.

- Keep a record of side effects. If a generic makes you sick, document it. That’s your leverage in an appeal.

Generics saved the U.S. healthcare system billions. They’re safe. They’re effective. But they’re not all created equal - and your insurer’s choice isn’t always yours. Knowing how the system works isn’t just helpful. It’s necessary.

Why does my insurance cover one generic but not another that’s the same?

Even though two generics have the same active ingredient, insurers pick one based on cost. If Generic A costs $3 and Generic B costs $7, and both work equally well, the insurer will only cover Generic A. This is called a “preferred generic.” You may pay more - or get denied - if your prescription is for the non-preferred version.

Can I get a brand-name drug instead of the generic my insurer covers?

Yes - but you’ll pay more. If your insurer covers a generic, they’ll require you to try it first. If it doesn’t work or causes side effects, your doctor can file an exception. If approved, you can get the brand-name drug. But you’ll likely pay the full non-preferred price, which could be 3-5 times higher than the generic.

Do all insurers use the same formulary rules?

No. Medicare Part D plans follow federal guidelines and mostly use 3-5 tier systems with generics in Tier 1. Private insurers like UnitedHealthcare, Cigna, and Blue Cross have similar structures but can set their own preferred drugs, copay amounts, and substitution rules. Some require prior authorization for certain generics. Always check your specific plan’s formulary.

How long does it take to get a drug covered if it’s not on the formulary?

Insurers must respond to an exception request within three business days. If it’s an urgent case - like you’re out of meds and your condition is worsening - they must respond in one day. If they don’t reply in time, your request is automatically approved. This is required by Medicare Part D rules and many state laws.

Why do some generics cause side effects when the brand-name didn’t?

The active ingredient is the same, but the fillers, dyes, and coatings can differ. For most people, this doesn’t matter. But for those with sensitivities - like people with epilepsy, thyroid disorders, or severe allergies - these inactive ingredients can affect how the drug is absorbed. That’s why some patients report new side effects after a switch. Always tell your doctor if you notice changes after a generic substitution.

Comments

Aysha Siera

January 18, 2026 AT 01:26They're just hiding behind FDA approval to sell us poison. I know someone who had seizures after switching generics. No one talks about this.

rachel bellet

January 18, 2026 AT 15:10The P&T committees are just cost-center arbiters operating under the illusion of clinical objectivity. The entire formulary architecture is a neoliberal artifact designed to externalize risk onto the patient while maintaining the façade of evidence-based decision-making.

Wendy Claughton

January 20, 2026 AT 12:34Thank you for explaining this so clearly. 💙 I had no idea pharmacists could swap meds without telling me. I'm going to check my plan's formulary tonight.

Tyler Myers

January 22, 2026 AT 09:20They're not just choosing generics-they're choosing who lives and who dies. Big Pharma owns the committees. You think your insulin is cheap? It's because they let ONE company make it. That's not capitalism. That's a cartel.

Ryan Otto

January 24, 2026 AT 05:42It is, of course, entirely predictable that the mechanism by which pharmaceutical cost containment is administered would be both statistically opaque and ethically compromised. The P&T committee, as a technocratic apparatus, functions not as a clinical gatekeeper, but as a fiscal algorithm disguised as medical authority. One must ask: when therapeutic equivalence is reduced to a binary cost differential, what becomes of individual pharmacokinetic variance? The system does not account for bioavailability outliers-it merely optimizes for aggregate savings. And therein lies the pathology: the patient is not a subject of care, but a variable in a regression model.

Naomi Keyes

January 25, 2026 AT 10:13Wait-so if two generics are FDA-approved, but one is $3 and the other is $8, the insurer picks the $3 one? Even if the $8 one has fewer fillers? Even if it’s better tolerated? That’s not science-that’s accounting. And now they’re calling it ‘value-based care’? I’ve been on both. The $8 one didn’t give me migraines. The $3 one made me feel like I was walking through wet cement. My doctor said, ‘It’s covered.’ I said, ‘But it’s making me sick.’ He shrugged. That’s not healthcare. That’s a vending machine.

Andrew McLarren

January 25, 2026 AT 21:17While the structural inequities in formulary design are undeniable, it is equally imperative to acknowledge the systemic pressures under which Pharmacy & Therapeutics committees operate. Budget constraints are not arbitrary; they reflect broader fiscal realities within public and private insurance ecosystems. The challenge lies not in vilifying the process, but in advocating for transparency, patient-centered exceptions, and equitable access to alternative formulations. Reform must be data-driven, collaborative, and grounded in the principle that cost containment should never supersede clinical necessity.

Danny Gray

January 27, 2026 AT 18:12What if the whole system is designed to make you feel powerless so you don’t question why your meds are always out of stock? Think about it: if you’re constantly fighting to get the drug you need, you stop looking at who’s pulling the strings. The real story isn’t about generics-it’s about control. Who benefits when you’re stuck waiting three days for a prior auth? Not you. Not your doctor. Someone’s making money off your confusion.

Stacey Marsengill

January 28, 2026 AT 00:11They don’t care if you cry in the pharmacy aisle. They don’t care if your thyroid crashes because the filler in the $3 pill made your heart race. They just want the spreadsheet to look pretty. And you? You’re just a line item with a pulse.